Non-fungible tokens (NFTs) are assets that hold unique value. The data contained in the NFTs is stored on an immutable distributed ledger system. These are non-fungible assets, meaning they cannot be divided into smaller assets for partial ownership.

NFTs are created using various blockchain platforms. If you’re looking for the best platform to create, mint, and deploy your NFTs, this guide is the right place to start. We’ve jotted down the list of the top 5 best blockchains for NFT Marketplace Development in 2025 that you can leverage to create and deploy your own tokens.

This blog discusses the importance of blockchain in the NFT landscape, the factors to consider when choosing blockchains for NFT, and finally, the best blockchain for NFTs.

Understanding the Importance of Blockchain in NFT

According to Statista.com, the global NFT market revenue is projected to hit an estimated number of $2,378 million in 2025. In fact, the number of NFT users is gauged to grow to a whopping 16.35 million users by 2028.

The above numbers show the significance of the NFT industry in today’s dynamic world. The buying and selling of these unique assets through tokens is prominent on blockchain platforms. First, let us understand blockchain technology and its significant role in NFTs.

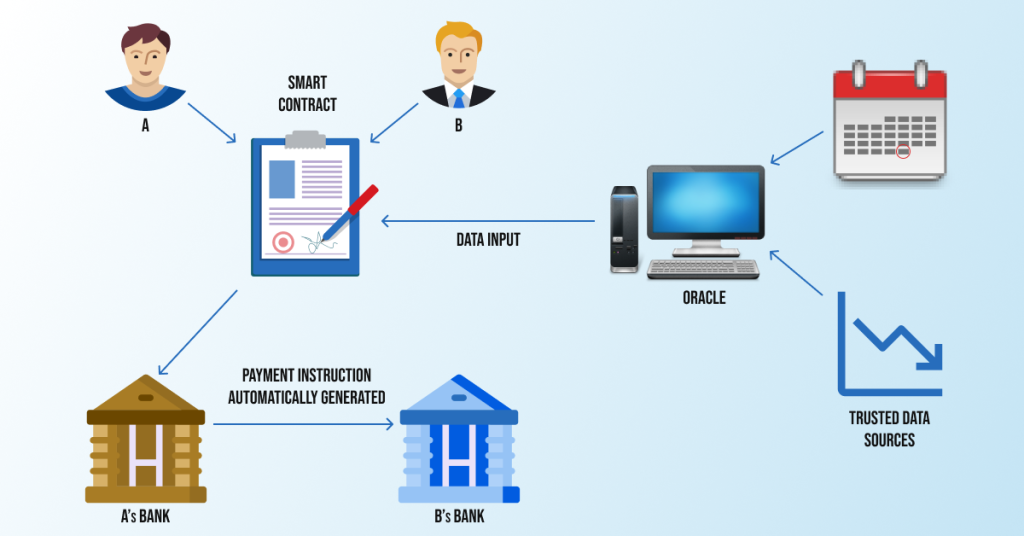

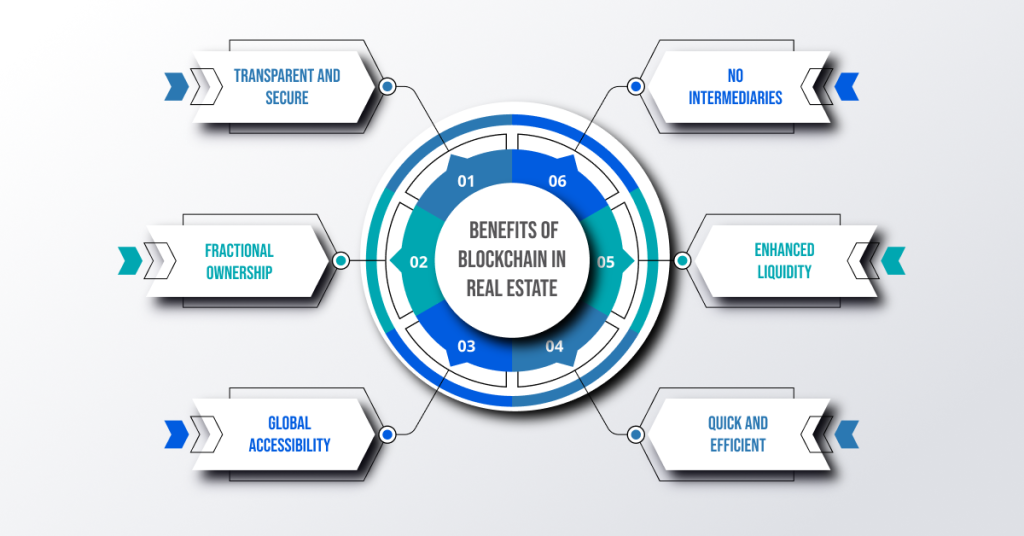

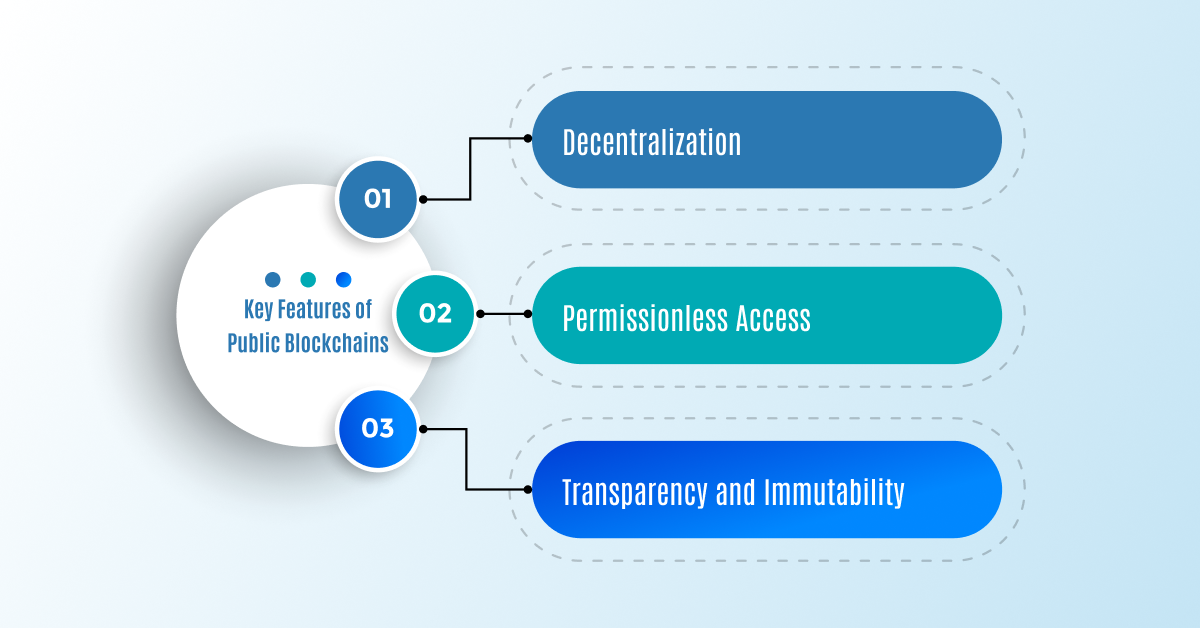

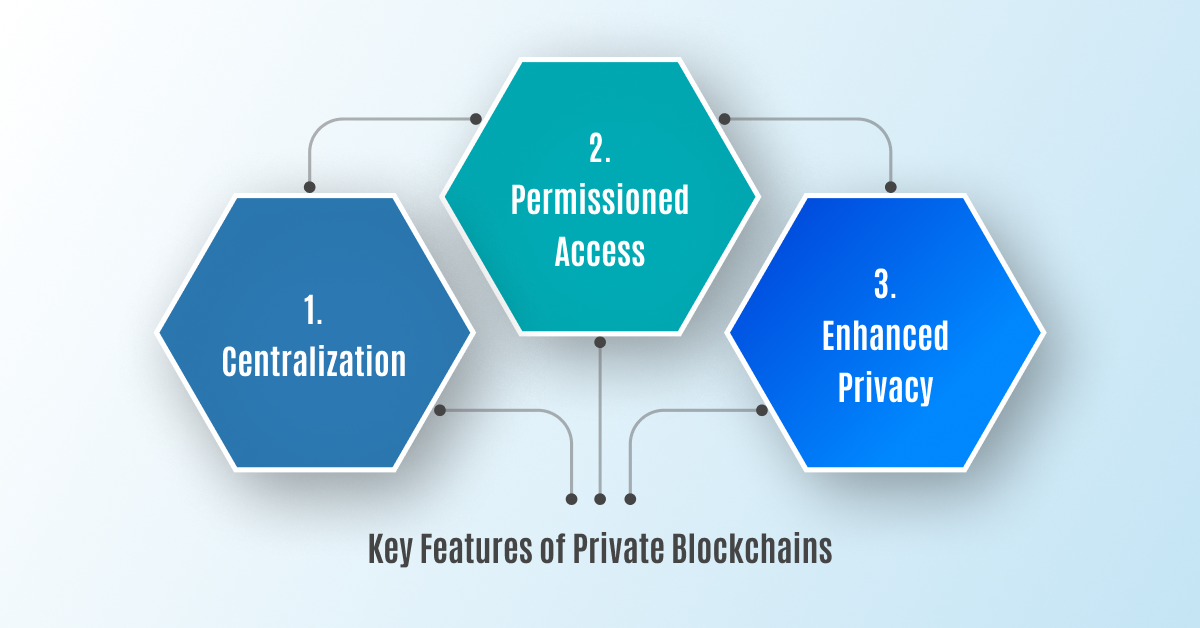

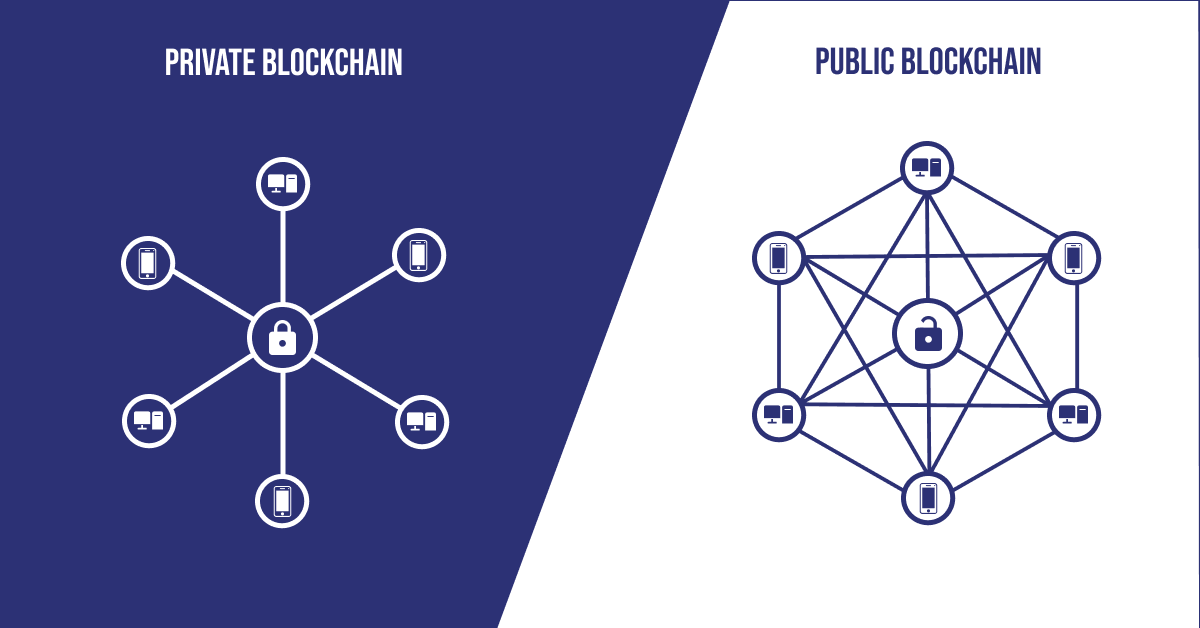

Blockchain is a decentralized distributed or shared ledger technology that creates a chain of transactional records that are autonomous, immutable, tamper-free and free of any third-party intermediary.

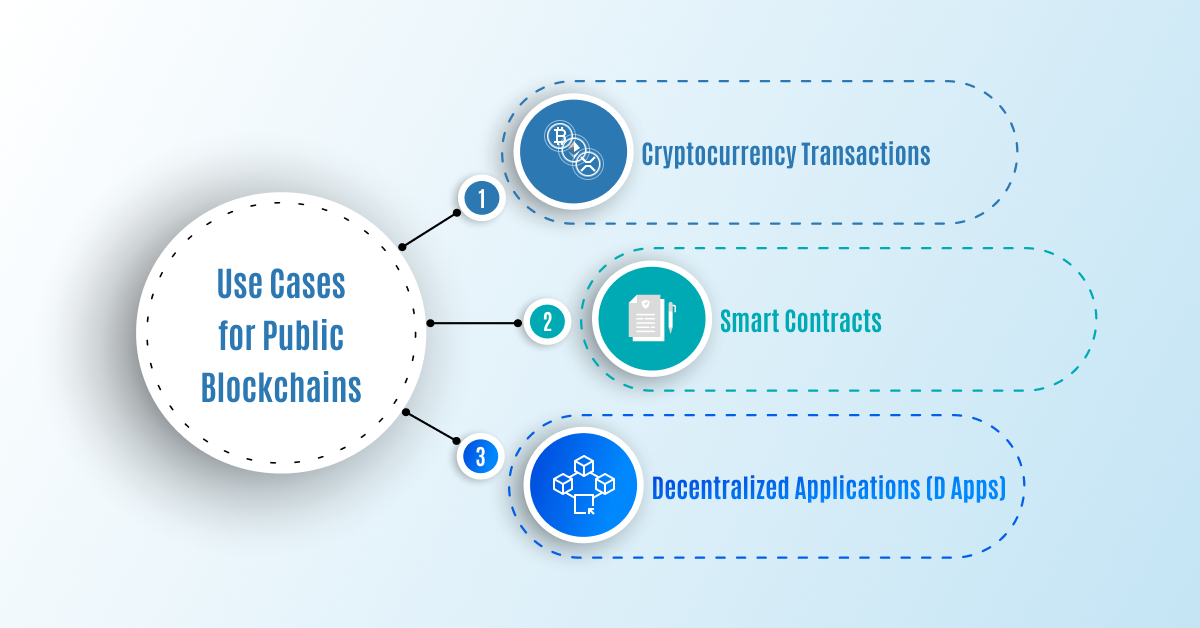

NFTs, such as artwork or collectibles, are built on top of the blockchain. Therefore, whenever an NFT is bought or sold, the transaction is stored on the immutable ledger. This non-fungibility ensures zero discrepancies in the digital ownership of the NFTs, along with the rarity of the assets.

Choosing the best blockchain to create NFT can be tricky, considering transaction fees, capabilities, and speeds. It is important to pick the right blockchain according to your requirements to offer an optimal user experience for your NFT marketplace or community.

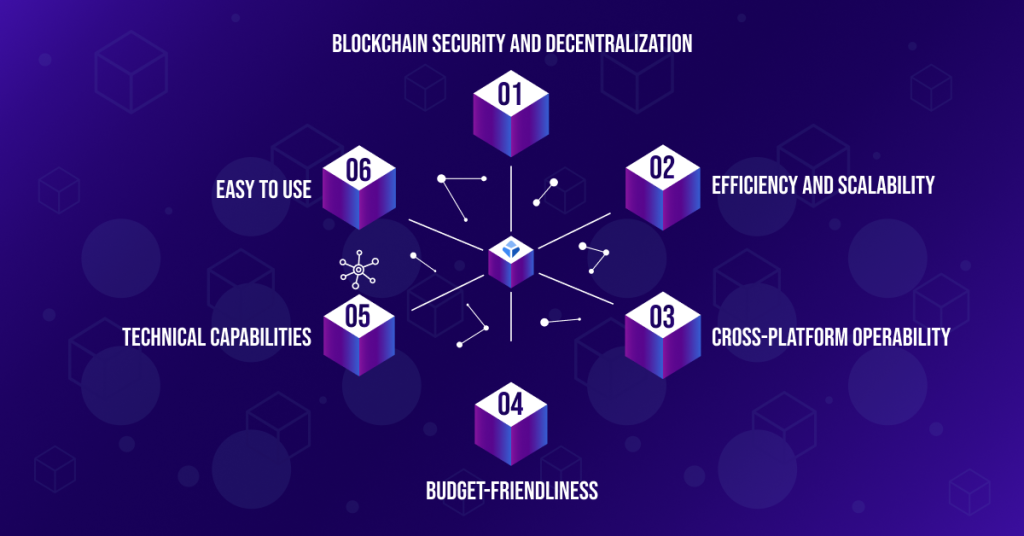

Factors to Consider When Choosing Blockchain for NFT

Let’s discuss the important factors to consider when choosing the best blockchain for NFT. The following factors are considered when choosing the best blockchain for creating and deploying NFT:

- Blockchain Security and Decentralization

It is important to consider the security levels of the blockchain on which you’re choosing to create your NFT. Blockchain security refers to a distributed network that allows data decentralization. One of the biggest advantages of blockchain is that the blockchain network itself is secure against cyberattacks or manipulation.

This is how decentralization and high security can influence the choice of blockchain for creating NFT.

- Efficiency and Scalability

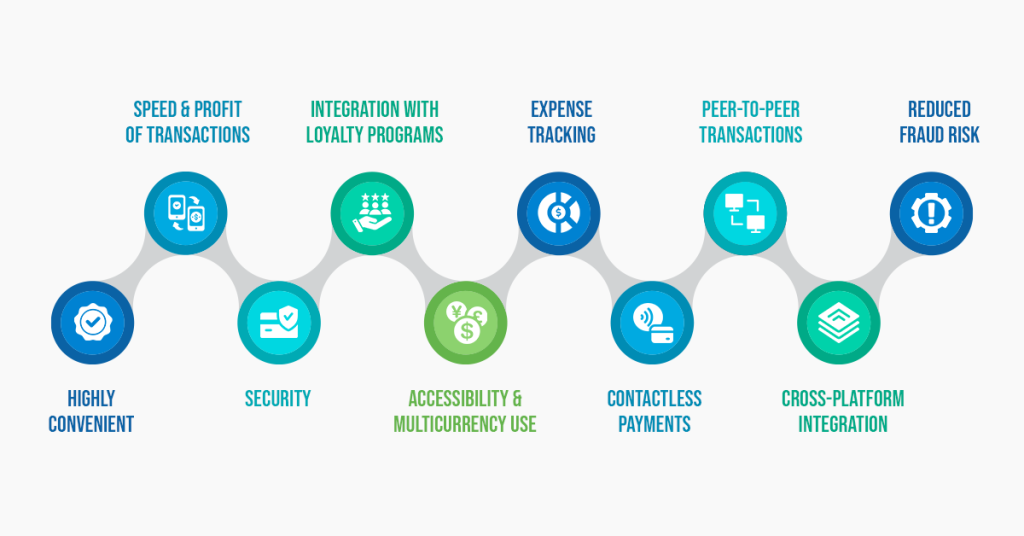

The minting and sale of NFTs must occur efficiently and rapidly without delaying the process, as it can become frustrating for the users. Any lagging in the processing of payments can become a problem, especially during price hikes or NFT launches.

A blockchain platform that allows the scalability feature can prevent network congestion for growing ecosystems. Therefore, a blockchain platform must be robust in transactions.

- Cross-Platform Operability

A lot of times, users have to access NFTs from various environments, such as crypto wallets, mobile games and metaverses. It is always better to choose a blockchain platform that is flexible and allows cross-platform transfers.

- Budget-Friendliness

Average NFT creators/users often do not want to commit to heavy gas fees or volatility costs on the blockchain platforms. On the contrary, stable and economical blockchain platforms are preferred by creators, innovators, artists, and NFT enthusiasts.

- Technical Capabilities

Another important factor is to look for a blockchain platform that supports NFT standards, meta-transactions, sophisticated smart contracts and staking opportunities.

- Easy to Use

A blockchain platform’s onboarding experience must be seamless and user-intuitive. In simple words, it should be easy to navigate through the platform to buy, sell and use NFTs.

Ready to Build Your NFT Marketplace? Talk to Our Blockchain Experts Today!

Best Blockchains for NFT Marketplace Development

It’s time to check out the best blockchain platforms for developing NFTs. The list is mentioned as follows:

1. Ethereum

After Bitcoin, Ethereum is the second blockchain created. When it comes to the most popular blockchain for NFT, Ethereum is the talk of the town. In fact, Ethereum is a renowned name as a well-recognized NFT marketplace.

But what owes popularity to the Ethereum platform? Let’s decipher.

- User-Intuitive:

The Ethereum Virtual Machine (EVM) is the easiest to use for creating NFTs. Sometimes, the user just needs to upload a file and enter the required information.

- No Ownership Disputes

Settling ownership disputes is simple and easy. This is because the metadata and transaction history are optimally recorded.

- Smart Contract Implementation

Thanks to the smart contract functionality, the creation and execution of NFTs are seamless in Ethereum. Smart contracts are self-executing digital contracts that execute when a certain set of conditions are met. Therefore, they ensure the immutability, security, integrity, and transparency of NFTs.

- Go-To Platform

Ethereum is a well-established name in the NFT industry. It also enables cross-chain functionality, meaning that NFTs can be accessed from multiple wallets, mobile wallets, metaverses, etc. Token standards—ERC-721 and ERC-1155—allow interoperability and make the development process easier.

The NFT marketplaces built on Ethereum are as follows:

- OpenSea

- Rarible

- SuperRare

2. Solana

After Ethereum, Solana is considered one of the best NFT marketplace development platforms. You cannot underestimate the power of this high-performance blockchain platform. Many renowned NFT collections are built using Solana, such as DeGods, Okay Bears, and Degen Ape Academy.

The notable features of this blockchain are as follows:

- High Scalability

The Solana blockchain platform is quite popular for its ability to handle large-scale decentralized applications and NFT marketplaces. It also offers quick transactions.

Fact Check: Solana processes 50,000 transactions per second.

- Economical

After Ethereum, Solana is the hotspot for NFT geeks. Many budding NFT creators and consumers prefer Solana because it has relatively lower gas fees than Ethereum.

- Developer-Friendly

As this blockchain platform is built using Rust programming language, Solana is a preferred choice for developers.

The NFT marketplaces built on Solana are as follows:

- Magic Eden

- Solsea

- Metaplex

- DigitalEyes

3. Tezos

Tezos is a blockchain suitable as an NFT marketplace development platform. The platform is well-known for its high security, on-chain governance and self-modifications. Overall, Tezos is a smart choice to top it off as an NFT marketplace because of its robust nature. Brownie points to the fact that this blockchain platform is relatively less crowded than Ethereum or Solana!

The highlighting features of this blockchain platform for NFT are mentioned below:

- High-Security

Tezos is a unique blockchain platform that uses formal verification to implement smart contracts. This phenomenon adds an extra layer of security to the NFT marketplaces built on Tezos, making them less prone to exploitation and attacks.

- Efficient Transactions

This blockchain platform leverages a layer 1 scaling solution called Liquid Proof-of-Stake (LPoS). This solution allows high speed and efficiency of transactions.

- On-Chain Governance

Tezos offers on-chain governance. This mechanism allows token holders to participate in the decision-making process, allowing the platform to evolve according to users’ changing needs.

The NFT marketplaces built on Tezos include the following:

- TRUESY

- Hic et Nunc

- OneOf

Fun Fact: Tezos is the first ever blockchain of its kind to launch a color as a part of artwork through NFTs.

4. Polygon

Imagine a power-packed NFT creation blockchain platform that acts as a Layer 2 scaling solution for Ethereum. It offers scalability, low fees, and compatibility with the Ethereum ecosystem, making it appealing to NFT marketplaces.

The following are the highlighting features of the Polygon blockchain platform:

- Scalability

Polygon addresses Ethereum’s scalability challenges by providing a layer 2 solution that enables fast and cost-effective transactions. The platform leverages the power of Plasma chains and sidechains, which allow Polygon to manage a large number of NFT transactions with minimal congestion.

- Ethereum Compatibility

Polygon offers cross-platform compatibility with Ethereum. This means that Ethereum-built NFTs can seamlessly interact with Polygon NFTs and smart contracts, expanding the reach and liquidity of Polygon’s NFT marketplaces.

5. Stellar

Stellar is a powerful blockchain platform built to cater to fast and economical transactions. It allows cross-border payments and provides efficient solutions for financial transactions. While primarily focused on financial services, Stellar’s unique characteristics make it suitable for NFT marketplaces as well.

Here are Stellar’s most usable characteristics suitable for the NFT marketplace:

- Fast and Low-Cost Transactions

Stellar’s consensus algorithm enables quick transaction confirmations, typically within a few seconds, making it suitable for NFT marketplaces where speed is essential. Additionally, Stellar’s low transaction fees make it cost-effective for creators and collectors to engage in NFT transactions.

- Built-in Decentralized Exchange (DEX)

Stellar has a built-in DEX that allows for seamless asset exchange. This feature enhances liquidity and enables Stellar’s NFT marketplaces to offer users a wide range of trading options and engagement opportunities.

Summing Up

Blockchain technology is part of creating, minting, selling, and buying NFTs on various marketplaces. This guide is the best read for beginners to find the best blockchain for NFT development. If you’re an entrepreneur or enterprise looking to develop NFT, look no further than Deftsoft. We offer custom NFT marketplace development services that suit your needs. Check out our official website to learn more!

Need Help Choosing the Right Blockchain Platform? Get a Free Consultation!

FAQs:

1. What is the role of blockchain in the NFT marketplace?

Non-fungible tokens (NFTs) are assets that hold unique value in the digital landscape. They can be digital collectibles or artwork. NFTs are built over the blockchain and can also be minted, bought, or sold. Therefore, blockchain lays the foundation for enabling the secure and decentralized transfer of ownership of the NFT tokens.

2. How to choose the best blockchain for NFT?

NFT creators and consumers can choose the blockchain platform based on their economic budget, target community, technical capabilities, scalability and platform complexity. For example, if you’re a gaming enthusiast working on a gaming NFT, Ethereum is the best platform for you, considering its large user base and gaming community. However, if you’re looking for low-cost options, Polygon or Solana is the best option as they have relatively lower gas fees.

3. Where can I find the best NFT marketplace development services?

It is pivotal to choose a reliable NFT marketplace development company that offers highly customized, sophisticated and budget-friendly marketplaces. Deftsoft offers custom NFT marketplace development services that meet your needs. From NFT creation to listing and marketing it, we do it all.

4. How do beginners choose the best blockchain for NFT?

When new to the NFT community, one must consider some specific characteristics when choosing the best blockchain. Some important traits include low gas fees, a niche-specific NFT community, blockchain platform scalability, cross-platform feasibility to interact with other NFTs and platform scalability. Deftsoft, a reliable NFT marketplace agency, can help you build your NFT and sell it on the marketplace from scratch.

5. Which is the most popular blockchain for NFT?

Considering the platform’s agility and ease of transactions, Ethereum is one of the most popular blockchains for NFT. Ethereum is a high-value blockchain platform with a dedicated community and space for almost every niche.