Crypto Fundraising Mainstream Mania: ICO vs. IEO

-

By Paramjit Singh

-

20th March 2024

The crypto crowdfunding landscape has been revolutionized since 2013, when Mastercoin held a token sale in July, also known as an ICO.

Let’s keep the details of an ICO for later. With the advent of blockchain, the world is escaping the traditional methods of crowdfunding for startups and business organizations. This is when we talk about Initial Coin Offering (ICO) and Initial Exchange Offering (IEO). These offerings are a form of token fundraising without the intervention of third-party beneficiaries, such as banks or other financial institutions.

This blog introduces you to the concepts of ICO and IEO, their benefits, how to develop ICO and IEO, and their differences.

What is Meant by an ICO?

Expanded as an Initial Coin Offering (ICO), an ICO is a pioneering fundraising token that can be exchanged or traded through a holding company’s own platform. Until 2019, it was one of the most preferred methods for crowdfunding, and it started replacing the VC funding landscape.

Investors saw ICOs as a lucrative investment instrument, as they gave them a swift ticket for raising funds in a portfolio of companies. ICOs can be public or private. The simplest working model of an ICO is for companies to issue various tokens related to a utility, such as an app, service, or cryptocurrency. Interested investors can buy these tokens from the platform in the form of cryptocurrencies or tokens, which can either be spent on the platform or traded.

The Benefits of ICO

Startups preferred ICOs because of the following reasons:

- It is a swift ticket to raise funds without any interference from third-party intermediaries or financial institutions.

- Companies can raise money faster with less red tapes.

- ICOs are a global passport for a large pool of investors.

Investors preferred ICOs because of the following reasons:

- It gives them a front-row seat to invest in budding projects.

- ICO gives investors an opportunity to invest in companies with high risk and reward ratios.

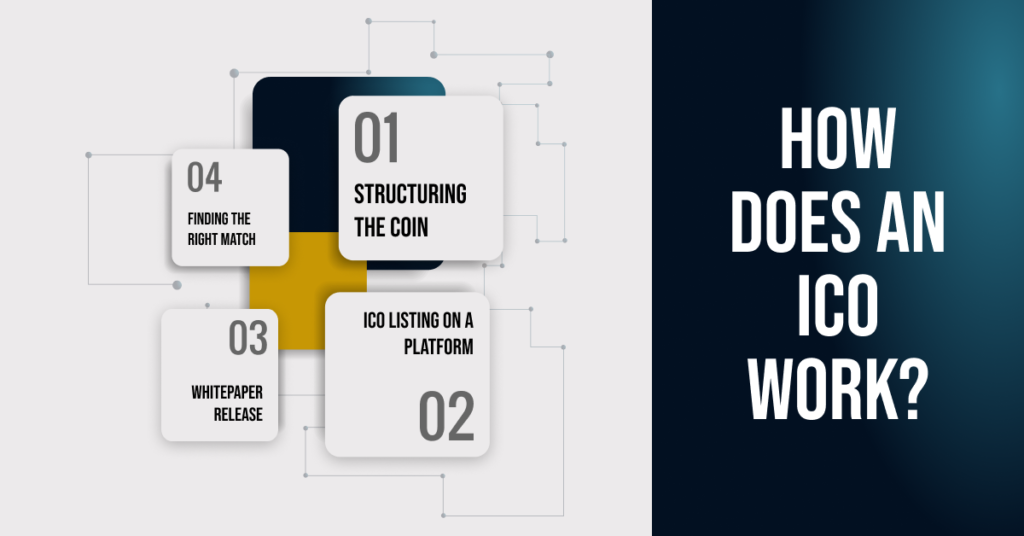

How Does an ICO Work?

An ICO works in the following series of steps:

- Structuring the Coin

The first step to raising money through an ICO is to decide the structure of the coin. The company generating an ICO can choose any one of the following structures for a coin:

- A preset price with a fixed token supply,

- A flexible price decided by the amount of funds received but with a limited number of tokens, or

- A flexible supply of tokens with a fixed price for each token.

- ICO Listing on a Platform

The company can then list the specific structure of its ICO on its created listing platforms. Think of an ICO as a blockchain version of an Initial Public Offering (IPO) to raise money for a project.

- Whitepaper Release

Releasing a reliable whitepaper is the very essence of raising money. Companies must be transparent about their goals and objectives. The whitepaper must also include the complete sequence of steps to achieve these goals.

- Finding the Right Match

Interested investors can then trade their fiat or digital currency in exchange for company cryptocurrency tokens. These tokens represent owning a share in the company, just like an IPO.

The Downfall of ICO

One of the downsides of ICOs is that they are very unregulated. Over the years, investors have been victims of a large number of fraudulent activities on various blockchain platforms when investing in ICOs. Although ICOs became successful, a number of problems led to their downfall.

According to a recent study by icobench.com, the highest number of ICO failures occurred between 2017 and 2019, with an average downfall of 28.9% over the three years. The coin fell below 5% after 2019.

Some of the major reasons for the downfall of Initial Coin Offering (ICO) included the following:

- Investors did not conduct a background check of the individual members before funding the project.

- There was no exchange of whitepapers before proceeding with the project. It is crucial to read and analyze the whitepaper. To clarify, a whitepaper is a summary of any blockchain-related project with its goals, objectives, and participants’ information.

For example, a company named PlexCoin raised over $15 million through a scammy whitepaper that easily hoaxed the investors. It was only when the U.S. Securities and Exchange Commission (SEC) stepped in to shut it down.

What is Meant by an IEO?

An Initial Exchange Offering (IEO) is an improved version of an initial coin offering (ICO). Commonly considered ICO 2.0, IEO is an evolved version of ICO equipped with regulatory properties. It was introduced in 2019 when the entire ICO market witnessed its unfortunate demise.

IEOs function just like ICOs but act like a gatekeeper. One of the most highlighting features of an IEO is that it can be traded via trusted cryptocurrency exchange platforms, such as Ethereum, Binance, EOS, etc., for token sales.

After the downfall of Initial Coin Offerings (ICOs), IEO became the default choice of preference for both investors and companies seeking quick investment. IEOs can be raised through various IEO launchpad platforms, such as Binance and Ethereum.

The power of an IEO is evident from the fact that BitTorrent raised $7.2 million in just a few minutes through the Binance launchpad.

The Benefits of IEO

The benefits of IEO for the startup landscape are mentioned as follows:

- They can potentially raise funds from a larger pool of investors.

- Listing and trading are done via trusted blockchain exchange platforms, which adds an extra layer of legitimacy to the fundraising process.

The benefits of IEO for the investors are mentioned as follows:

- IEOs are comparatively safer platforms than ICOs for investing in a company.

- IEOs are exchanged on cryptocurrency exchange platforms. These platforms strictly follow KYC and AML rules and are restricted to a certain number of countries.

- The process for token purchase is simple and straightforward.

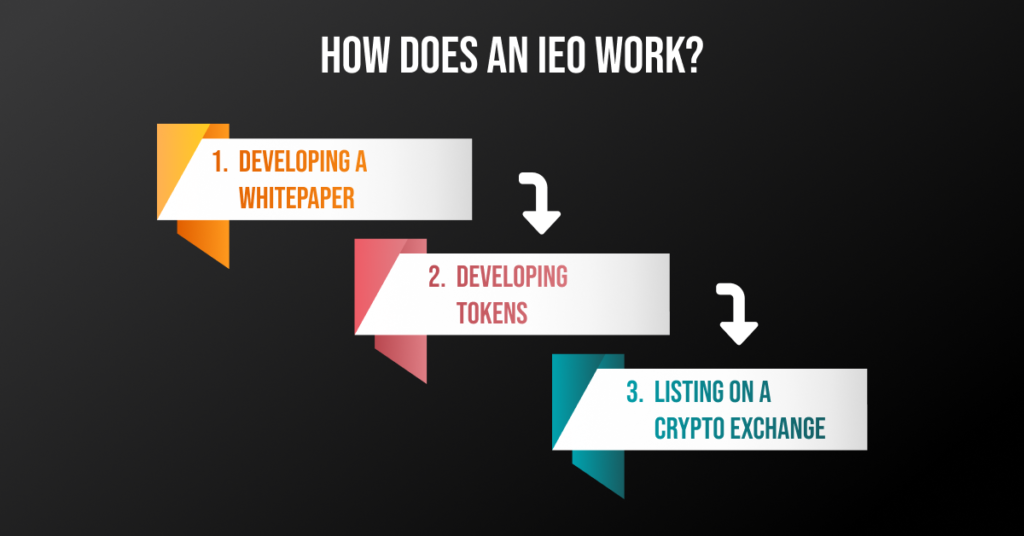

How Does an IEO Work?

The working of a typical Initial Exchange Offering (IEO) follows the below-mentioned steps:

- Developing a Whitepaper

Similar to an ICO, an IEO also requires you to create a whitepaper. The company seeking to raise funds must mention all the relevant details, such as the objectives and goals of fundraising, the architecture, and the technical features of the product. Startups must ensure that a whitepaper is written thoroughly along with reliable background information on the projects since the blockchain exchange platforms also go through the whitepaper.

- Developing Tokens

The next step is to develop tokens for sale. Tokens can be created through various blockchain platforms, such as Ethereum, EOS, Ripple, NEO, etc. Once minted, they can be listed on a third-party exchange platform.

- Listing on a Crypto Exchange

A company looking to raise funds must partner with a reliable launchpad to get listed on a crypto exchange platform. For instance, the Binance launchpad is one of the most popular launchpads. An agreement is signed with the platform.

Note: It is important to create a Minimum Viable Product (MVP) to get listed on a blockchain exchange platform.

What is the Difference Between ICO and IEO?

Let’s explore the main differences between ICO and IEO.

- Level of Scrutiny

Since IEOs are exchanged via blockchain exchange platforms, they follow a high level of rules and regulations. Companies that want to raise funds need to sign an agreement with the blockchain exchange platform and pass Due Diligence. The process also includes screening the members through the whitepaper and ensuring that the project is attainable and realistic.

On the other hand, ICOs are not regulated and scrutinized because they are not listed on third-party exchange platforms.

- Cost of Listing

The IEOs are comparatively more expensive than ICOs. The cost of listing an IEO on blockchain exchange platforms can go as high as 30 BT. Also, these listing platforms charge as much as 10% of the earnings from the sold tokens. Therefore, IEOs are not economical to raise.

Since ICOs are raised on an indigenous platform, no additional listing fee is involved.

- Entry Barrier

ICOs usually happen in three stages: private sale, pre-sale, and main sale. The biggest investors buy tokens with the highest discounts, followed by medium and small investors. This creates disparity amongst investors.

On the contrary, IEOs are open to both public and private sales of tokens. Investors are not discriminated against.

- Liquidity

IEOs are more liquid than ICOs. They can be listed immediately after the token sale, ensuring high liquidity and the ability to roll out in the market. ICOs are illiquid and take considerable time to list after being sold.

Looking for an ICO and IEO Development Company?

In the dynamic world of blockchain, companies, and startups are thriving to raise funds via ICOs and IEOs. Deftsoft caters to these emerging fundraising needs by providing top-notch ICO development services. We also offer custom IEO development services to help you get listed on the most popular blockchain exchange platforms, such as Binance and Ethereum.

Invest diligently in an ICO software development company to make your idea a reality.

FAQs:

What is the difference between ICO and IEO?

ICOs and IEOs are tokens for fundraising through cryptocurrency or other digital currencies. An initial Exchange Offering (IEO) is a successor to an Initial Coin Offering (ICO) since it is highly regulated compared to an ICO. This is because IEOs are listed on third-party blockchain platforms. Other major differences include the fact that IEOs are more liquid than ICOs; they’re open to investment irrespective of the size of the investor. One downside of an IEO is that it is more expensive than an ICO.

Name some third-party blockchain platforms for listing IEOs.

Some of the most popular third-party blockchain platforms for listing IEOs include Binance, EOS, Ripple, Ethereum, NEO, etc.

How do you find a suitable ICO software development company?

The foremost criterion for finding a suitable software development company is to look for a blockchain token development company that offers custom solutions. Deftsoft offers flexible ICO and IEO token development services to help you raise funds for your venture efficiently and economically.

What are the benefits of ICO?

The benefits of ICOs include the following: ICOs are economical and are a quick scheme to raise funds from whale investors. It can be launched through a curated platform or the company’s own website. Companies can raise money quickly with few red tapes or strict regulations. Investors can invest in hidden gem companies with high risk-to-reward ratios.

What are the benefits of IEO?

The benefits of IEOs include the following: IEOs are a safer bet on token sales because they’re highly regulated. Investors prefer IEOs because they’re listed directly on popular and reliable blockchain platforms. IEOs are more liquid than ICOs and offer more transparency.

Paramjit Singh

20th March 2024

20th March 2024