The Future of Digital Wallets: From Payments to SuperApps

-

By Amardeep Singh Sandhu

-

1st February 2024

It was the last decade when we got introduced to the concept of cryptocurrencies, DeFi, and blockchain. Crypto was something that really thrilled us and became the market of $1.74 trillion. However, it’s not a hot topic today anymore, but we are imagining a big picture in the future.

Blockchain, A2A payments, decentralized finance (DeFi), and CBDCs are some of the latest Finance technologies that offer the possibility of strong and secure finance management. And Digital Wallets are one of them!

Let’s show you a cashless future. You don’t have to carry any cash or any credit or debit card. Just simply take your smartphone, snap with your scanner, enter your pin, and you’re done! This is how software development in fintech shows off.

This groundbreaking transformation has been only possible via digital wallets like Apple Pay, Amazon Pay, Google Pay, and PayPal. In 2022, Apple Pay shared that they have over 535.8 million users.

Digital Wallets Development: How Did We Come Here?

Logically, Coca-Cola was the one who arguably put the foundation of digital wallets by simply ignoring cash. So, if you were in Helsinki in 1997, you would be able to use the first vending machines that accept payments by text message instead of coins.

Soon super app development boosted up! This phenomenon has created too much hype in cashless mobile payments and badly teased most of the fintech companies like PayPal, Beenz, and Floonz.

In the 90s, eBay used to receive money via money orders and checks without any means of payment on the Internet. This was an opportunity for PayPal, and they launched an electric payments system in 1999 to allow users to send money by email money.

As we all know, the market is always rushed with competition. Soon, mobile payment services like Alibaba’s Alipay (2003) and Kenya’s M-Pesa (2007) got the lead among billions of users.

The further evolution was led by Google. In 2011, Google also joined the league, introducing its “Google Wallet,” which was considered the “first mobile wallet” by many. However, it wasn’t globally accessible as it was only compatible with Citibank. Now, we are using Google Pay, which is quite advanced today!

Talking about today’s landscape, we have advanced digital wallet-powered cloud solutions and near-field communication (NFC) technology. Anywhere at any time, pay or receive without any hassle! Over 75% of customers use digital wallets for their day-to-day transactions at physical and online stores.

How Do Digital Wallets Work?

With these virtual tools and super apps, you can easily make electronic transactions, whether it’s for online shopping, in-app purchases, or in-store payments. But do you know how it works?

Digital wallets are a replacement for traditional wallets, but they demand something extra. If you want to experience instant payments, you have to sign up for digital wallets and share your personal information and sensitive banking details. For high-end security, digital wallets store your data with complex encryption in their cloud repository.

So, whenever you make a purchase via these digital wallets, you don’t have to go through any hassle. (No need to manually fill in the details) All you need to do is approve the transaction by entering your password or PIN.

These payment apps can do bank-to-bank transactions instantly. Users can also load money into their digital wallets by transferring funds from linked bank accounts or credit/debit cards. This can usually be done through the wallet provider’s app or website.

All digital wallet development providers follow various security measures (biometrics or tokenization) to make it better. In tokenization, many Digi-wallet platforms replace your actual card number with a token. Commonly, they only remember the ending 2-4 digits to represent your card information.

This token will be shared with the merchant while making any process. You can also customize your wallet and use different finance tools within the platform. Some digital wallets also support the addition of loyalty cards, gift vouchers, and other types of payment methods.

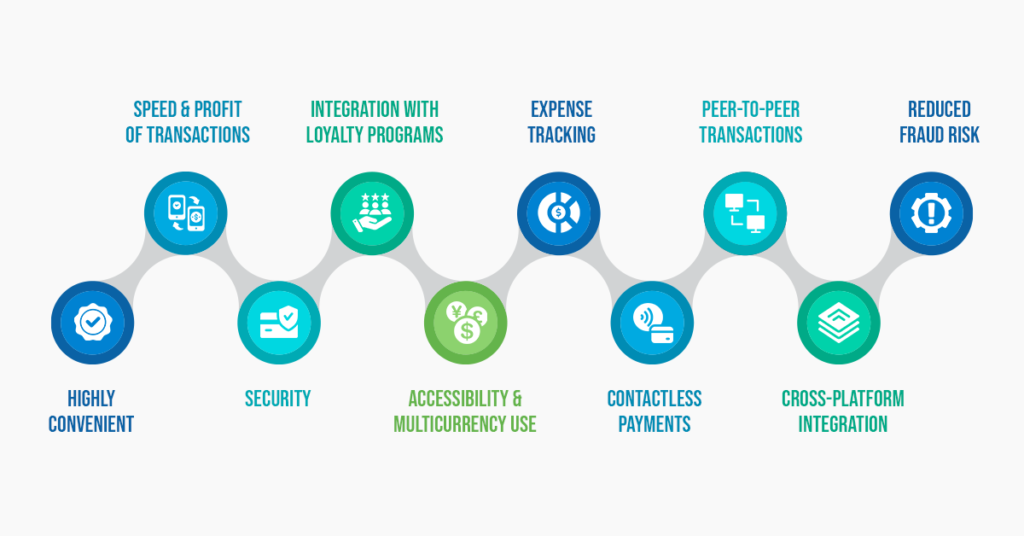

Benefits You Should Know

A few years back, the daily use of digital wallets increased surprisingly in China (45%), India (35%), and Brazil (20%). Not only that, according to a report from Juniper Research, 60% of people will use digital wallets globally.

Well, the reason is simple: There are numerous benefits of using digital wallets that can result in profit. So, let’s talk about them.

1. Highly Convenient:

As we have discussed a lot yet, payments with digital wallets are the most convenient way to make transactions without the need for physical cash or cards. People can use these super apps or super wallets to make payments with just a few taps on their smartphones, which is particularly handy for quick and on-the-go transactions.

Whether it’s 2 AM or 2 PM, you can receive or send money, book online tickets, buy your favorite shoes, and much more without worrying about anything.

2. Speed & Profit of Transactions:

Digital wallets facilitate faster transactions compared to traditional payment methods. Contactless payments, especially those using Near Field Communication (NFC), are quick and efficient, reducing the time spent at checkout counters.

Also, you don’t need to pay any kind of transaction fees that you might face in debit or credit cards. It is a major advantage for those who are struggling with international or frequent transactions. Many services like MoneyGram and Western Union charge very high fees and can take days for international money transfers.

3. Security:

Digital wallets have advanced security measures, such as encryption, tokenization, and biometric authentication (fingerprint, face recognition) to protect users’ sensitive information.

The fresh Decentralized ID (DID) integration has also raised security standards. DID is a kind of digital identity created by digital wallets in decentralized finance to store their banking and card credentials with top encryption.

4. Integration with Loyalty Programs:

Many digital wallets allow users to integrate their loyalty cards and reward programs directly into the app. This means users can earn and redeem rewards seamlessly during transactions, consolidating their loyalty memberships in one place.

5. Accessibility & Multicurrency use:

With advanced finance custom software development, many companies are creating highly secure wallets. These super wallets can be accessed from various devices, including smartphones, tablets, and smartwatches. This flexibility enhances accessibility, allowing users to make payments from their preferred devices anywhere.

If we are talking about global use, currency barriers shouldn’t be the issue. Digital wallets can be more versatile, supporting cryptocurrencies and fiat currencies. Moreover, you can perform a real-time currency amount conversion in real-time.

6. Expense Tracking:

Digital wallets often provide users with detailed transaction history and electronic receipts. This feature helps users track their spending more effectively and manage their budgets.

7. Contactless Payments:

Digital wallets are well-suited for contactless payments, which have become surprisingly popular, especially in the context of the COVID-19 pandemic.

The pandemic has accelerated the adoption rate of contactless payments, with around 50% of consumers considering it one of the most important safety features in retail stores, according to a survey by Visa. Users can make payments without physically touching cash or card terminals, reducing the risk of transmitting germs.

8. Peer-to-Peer Transactions:

Many digital wallets support peer-to-peer transactions, enabling users to send money to friends, sellers, and family quickly. This feature is useful for splitting bills, sharing expenses, or sending gifts.

9. Cross-Platform Integration:

Some digital wallets are integrated with other apps and services, allowing users to make payments seamlessly within various ecosystems. For example, users can make in-app purchases, pay for rides, or order food using their digital wallet.

10. Reduced Fraud Risk:

Digital wallets often incorporate features like two-factor authentication and fraud detection, reducing the risk of unauthorized transactions. In addition, the use of virtual tokens instead of actual card numbers enhances security.

Improvement Areas for Digital Payments

1. Security Issues

While these virtual payments are often considered to be highly secure, they can also draw the attention of cybercriminals. A single fraudulent tactic and malfunction can let scammers steal our funds or sensitive data.

Also, what if you lost the phone on which your credentials are saved? It’s pretty sure that anyone can misuse it for unauthorized transactions. In such cases, wallets should have tight security from their end.

Today, 93% of people are scared of hacking and other cybercrimes. It’s important for all digital wallet providers and companies to perform regular security audits, updates, secure encryption, or authentication to protect customer data.

2. Absence of Standard and Accessibility

Today, all E-commerce platforms and Fintech companies are launching their own digital wallets. Even WhatsApp has its own! But why isn’t a significant population able to use it?

Users commonly encounter a lack of uniformity across various mobile payment systems and digital wallets. It can create a little confusion in selecting the appropriate payment option.

Also, not all merchants accept digital wallets, and you always need an internet connection for it. It may create trouble in some situations. Imagine you went on a vacation in a rural area without any cash, and there’s no internet connection.

In such scenarios, Fintech giants really need to enhance connections to promote broad use.

3. Technical Challenges

If you use digital wallets, you must have stumbled over issues with software compatibility, system crashes, and scalability. For example, you’re passing through a payment gateway, and you get stuck with endless buffering. Now, you can’t refresh the page or conduct a new transaction because of the fear of losing money and waiting for refunds.

Solutions should try partnering with experienced developers, thorough testing, and debugging.

How Digital Wallets Are Expected to Grow in the Future: Top Trends

1. Crypto Wallets

Crypto and investments are easy now! Digital wallets are also the future of Fintech, crypto, blockchain, and other emerging technologies. You can buy, store, invest, or trade your cryptocurrencies with some digital wallets like MetaMask and Trust Wallet.

The rise of super apps such as Google Pay, Samsung Pay, and Amazon Pay are also offering ways to invest your money. If there’s something you can do with real money, you can do the same with digital wallets!

2. Blockchain & Smart Contracts

Blockchain in digital payments allows the implementation of smart contracts. These smart contracts are self-executing, which means the whole agreement is directly written into code. This feature automates and enforces contract execution, reducing the need for intermediaries.

3. Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) simply means that you buy something today and keep paying it later in installments. It’s not a new concept, but it’s growing rapidly. Searches for “BNPL” have risen by 790% in the last five years, with one in three American shoppers likely using a BNPL program in 2022.

BNPL is projected to surpass $1 trillion in global spending by 2025, comprising 5% of worldwide eCommerce spending. Despite its popularity, regulatory bodies are scrutinizing major BNPL providers, including Affirm, Afterpay, Klarna, PayPal, and Zip.

4. Smart Speakers

The use of smart speakers and similar devices for making payments and conducting transactions through voice commands has seen a significant rise in recent years.

As of the latest estimates, more than 120 million smart speakers are owned by Americans, a substantial increase from just 20 million in 2017. Amazon Echo continues to dominate the market share among smart speakers.

Interestingly, even in 2017, 28% of smart speaker owners were already using voice commands to send money and make payments. With the increasing adoption of smart speakers for shopping purposes, the number of users making payments through these devices is expected to grow further, even more so with digital wallets.There are endless opportunities, mobile development, and emerging trends in the further evolution of digital payments. Virtual cards, predictive analytics, biometric authentication, crypto wallets, and more are coming this way to enhance your experience.

Top 5 Super Apps or Digital Wallets to Use in 2024

Software development has grown a lot with advancements to create super apps. Here are some of the 5 most popular super apps you should take a look at.

- Apple Pay

- Google Pay

- Amazon Pay

- PayPal

- WeChat Pay

Bottom Line

Digital payments and super apps did such an amazing job in the world of finance. We expect we will soon be able to make investments with our fingertips in seconds. However, there are so many challenges, and we are still so far. It would be amazing to watch how technology grows with time.

For more such content, stay connected with Deftsoft.

Recent Articles

-

Unity vs Unreal Engine 5: Which is Better?

-

Non-Negotiable Tips for Developing a P2P Lending Platform

-

The 8 Leading Cross-Platform App Development Frameworks You Should Know

-

Step-by-Step Guide: How to Build a dApp on Ethereum with Ease

-

Why Does Your Business Need Blockchain Development Company’s Expertise?

Amardeep Singh Sandhu

1st February 2024

1st February 2024